We expect this Business Combination will create a leading company in the global distribution of hemp and cannabinoid-based products.

LAS VEGAS, NV, March 03, 2021 /Neptune100/ — Global Cannabinoids (“GC”), a leading bulk and wholesale B2B manufacturer and distributor of hemp-derived cannabinoids and finished products is pleased to announce a proposed business combination transaction (the “Business Combination” or “Transaction”) with EXMceuticals Inc. (CSE: EXM) (FSE: A2PAW2) (“EXM”), an emerging bio-sciences company specializing in the production of unique cannabinoid formulations. We expect this Business Combination will create a leading company in the distribution of hemp and cannabinoid-based products (the “Combined Company”). Following the completion of the Business Combination, the Combined Company will operate under the GC’s corporate name.

The Business Combination brings together GC, which is a leading US-based online platform for the production, manufacture and distribution of premium wholesale American hemp oil, extract, isolates and finished products with EXM, which will allow the Combined Company to conceivably expand beyond the US and import, export, research and refine cannabinoids and cannabis-based products through EXM’s Portugal hub into the European Union.

“The team at EXM shares the same vision for the future as we do. GC’s commitment to quality, consistency and best in class pricing, combined with EXM’s global reach, will allow for rapid expansion to customers in emerging markets. We are excited for the opportunities ahead,” stated GC’s Chief Executive Officer Kelly Ann Lewis-Bortman.

“EXM could not be more excited to combine operations with GC. As pioneers in the industry, the management team at GC have built a very impressive business footprint and distribution network while generating meaningful revenue. GC provides B2B customers with products and services that deliver an unmatched level of consistency and quality in the fastest possible time. We feel enormous growth opportunities exist in the US marketplace and beyond, with EXM’s operations in Portugal providing an immediate springboard to access the entire emerging European marketplace, for all legal cannabinoids,” commented Jonathan Summers, CEO of EXM.

Together, the US- and Vancouver-based companies will focus on expanding their footprint worldwide catering to hemp, CBD and ultimately cannabis-based products. The combined team’s deep global network will complement the organic cost saving synergies of the Business Combination as the Combined Company continues to pursue market share in the projected $123 billion CBD market by 2027.

Proposed Transaction

GC has entered into an exclusive non-binding letter of intent (the “LOI”) effective February 28, 2021 with EXM, pursuant to which the parties propose a business combination whereby EXM and GC would combine their respective businesses. Pursuant to the LOI, the parties will work to prepare and execute definitive transaction agreements (the “Definitive Agreement”). The Definitive Agreement is expected to provide for the combination of EXM and GC through the issuance of an aggregate of 168,000,000 common shares of EXM (“EXM Shares”). The Parties have agreed to exclusivity, and completion of the Business Combination will be subject to customary closing conditions to be set forth in the Definitive Agreement. EXM and GC expect to enter into a Definitive Agreement within the next 30 days and close on the Transaction in Q2 2021.

After giving effect to Definitive Agreement, the holders of GC will own approximately 66% of EXM’s issued and outstanding shares on a pro forma basis and existing EXM shareholders will hold approximately 33% of EXM’s issued and outstanding shares on a proforma basis. EXM is an arm’s length party to GC.

Highlights of The Transaction

Management believes the terms of the Business Combination are highly accretive to the Combined Company and we expect that strong revenue and cash flow from combined operations will position the Combined Company to be a global leader in the hemp-based CBD wholesale market and beyond.

• Market Opportunity: Positions the Combined Company to capitalize on the expected $123 billion global CBD industry by 2027 with a unique digital platform for the global distribution of cannabinoid-based products.

• Global Focus: GC’s strong sales channels combined with EXM’s existing assets and licenses in Portugal establishes growing global revenue capabilities and vertical supply chains in the emerging EU cannabinoid markets.

• Online CBD Leader: GC currently services over 70,000 customers across the US with over 1,000 product SKUs in 2020.

• Customer Focused Data: Distribution network for bulk wholesale and nationally recognized CBD brands across a wide array of customers provides valuable data, consumer insights, and product knowledge as global companies look to enter the cannabis & cannabinoid marketplace.

• Strong Sales Profile: GC generated sales of approximately $13 million in 2020 (unaudited) despite the disruptive effects of the global pandemic.

Luminous Capital acted as corporate financial advisors to both GC and EXM on the Transaction.

Combined Company Leadership Team

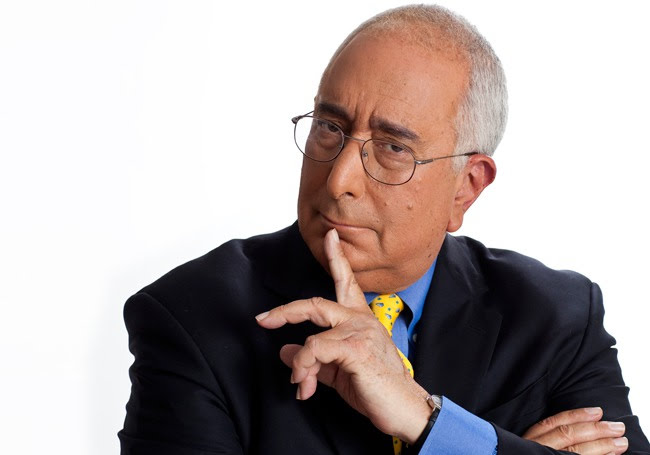

The Combined Company will be led by a best-in-class management team and Board of Directors, with strong track records in consumer packaged-goods, distribution and cannabis experience globally. Upon completion of the Business Combination, GC’s current Chief Executive Officer, Kelly Ann Lewis-Bortman, will lead the Combined Company and management team as the Chief Executive Officer. Jonathan Summers will be appointed the chairman of Combined Company. The combined Board of Directors will consist of a total of five members, three of which, including Mrs. Bortman, are current GC directors and two of which will be from EXM, one of which will be Jonathan Summers. EXM’s Chief Financial Officer, Mike Kinley, will continue as the Chief Financial Officer of the combined entity.

Additional senior leadership positions at the Combined Company will be named at a later date.

Forward Looking Statements

This press release contains certain statements or disclosures relating to the parties that are based on the expectations of management as well as assumptions made by and information currently available to the parties which may constitute forward-looking statements or information (“forward-looking statements”) under applicable securities laws. All such statements and disclosures, other than those of historical fact, which address activities, events, outcomes, results or developments that the parties anticipate or expect may, or will occur in the future (in whole or in part) should be considered forward-looking statements. In some cases, forward-looking statements can be identified by the use of the words “expect,” “anticipate,” “may,” “propose,” “believe,” “will” and derivatives of such words and other similar expressions. In particular, but without limiting the foregoing, this press release contains forward-looking statements pertaining to the following: completion of the Business Combination (including the terms and timing thereof, if at all), the Combined Company future success if the proposed Transaction closes, and the pro forma and other potential future combined metrics of the Combined Company.

The forward-looking statements contained in this press release reflect several material factors and expectations and assumptions of the parties including, without limitation: that the parties will continue to conduct their operations in a manner consistent with past operations; the general continuance of current or, where applicable, assumed industry conditions; availability of debt and/or equity sources to fund the Combined Company’s capital and operating requirements as needed; and certain cost assumptions.

The parties believe the material factors, expectations and assumptions reflected in the forward-looking statements are reasonable at this time but no assurance can be given that these factors, expectations and assumptions will prove to be correct. The forward-looking statements included in this press release are not guarantees of future performance and should not be unduly relied upon. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements including, without limitation: general economic, market and business conditions; increased costs and expenses; reliance on industry partners; access to appropriate capital, risks related to cannabis price fluctuations and a significant expansion in COVID-19 restricting or prohibiting the Combined Company operations or significantly impacting the Combined Company’s supply chain. Readers are cautioned that the foregoing list of factors is not exhaustive and are cautioned not to place undue reliance on these forward-looking statements.

The forward-looking statements contained in this press release are made as of the date hereof and the parties undertake no obligations to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

For Media:

Shawna Seldon McGregor

Maverick Public Relations

[email protected]

917-971-7852