For the first time in over a century, the United States no longer holds a perfect credit rating from any major agency. Moody’s Ratings downgraded the nation’s sovereign debt on Friday from its top-tier AAA to Aa1, pointing to a $36 trillion debt pile and a worsening fiscal outlook. The move, which aligns Moody’s with downgrades by Fitch Ratings in 2023 and S&P Global Ratings in 2011, sent ripples through markets and sparked heated debate about America’s financial future, just as Congress grapples with President Donald Trump’s ambitious tax cut plans.

Moody’s, the last holdout to maintain a pristine rating for the US since 1917, justified the downgrade by highlighting a decade-long surge in government debt and interest payments, now far exceeding those of other high-rated nations. “Successive administrations and Congress have failed to reverse the trend of large annual fiscal deficits and growing interest costs,” the agency said in a statement. It projects federal deficits swelling to 9% of GDP by 2035, up from 6.4% in 2024, with the debt burden hitting 134% of GDP, compared to 98% last year. Rising entitlement spending, higher interest rates, and sluggish revenue growth are driving the shortfall, worsened by proposals like Trump’s “One Big, Beautiful Bill,” which could add $3.3 trillion to the debt over a decade, per the Committee for a Responsible Federal Budget.

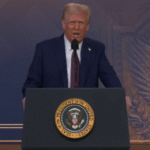

The timing couldn’t be worse. The downgrade came hours after the House Budget Committee rejected Trump’s bill, which aimed to extend his 2017 tax cuts and add new breaks, offset by cuts to Medicaid and food stamps. The bill’s failure, driven by conservative Republicans demanding deeper spending reductions, underscored the political gridlock Moody’s criticized. Trump’s team fired back, blaming the Biden administration’s “reckless spending” for the debt crisis. “If Moody’s had any credibility, they wouldn’t have stayed silent the past four years,” said White House spokesperson Kush Desai. Senate Minority Leader Chuck Schumer countered, calling the downgrade a “wake-up call” for Republicans to abandon “deficit-busting” tax giveaways.

The downgrade’s immediate market impact was muted—U.S. Treasury yields ticked up slightly, and stocks wobbled but didn’t crash. Some analysts argue the US remains a safe bet, thanks to its dynamic economy and the dollar’s role as the world’s reserve currency. “There’s little chance the US won’t meet its obligations in the medium term,” said a Bloomberg commentator, noting robust demand for Treasuries. But others warn of long-term pain. Higher yields could raise borrowing costs across the board, from mortgages to car loans, squeezing Americans already hit by inflation and tariffs. The Congressional Budget Office estimates debt could reach 107% of GDP by 2029, and a fiscal crisis—where investors lose confidence—remains a risk if deficits aren’t curbed.

Public reaction on social media reflects frustration and division. Some users, like @MichaelKdcl, scoffed at the timing, noting the AAA rating survived decades of debt accumulation and market crashes. “What a clown show,” they posted. Others, like @LibtardLover69, tied it to broader decline, claiming “our country is falling apart.” Economists are split too. Former Trump advisor Stephen Moore called the downgrade “outrageous,” arguing tax cuts boost growth, while Natixis economist Christopher Hodge warned of a “day of fiscal reckoning” if spending isn’t reined in.

The downgrade’s roots trace back years. S&P’s 2011 cut followed a debt ceiling standoff, citing “political brinksmanship.” Fitch’s 2023 downgrade pointed to “fiscal deterioration” and governance erosion, echoed by Moody’s now. The US faces a summer 2025 deadline to raise the debt ceiling again, or risk default, a scenario that spooked markets in 2011 and 2023. Meanwhile, entitlement programs like Social Security and Medicare, projected to eat up 78% of spending by 2035, remain politically untouchable, and tariff revenues haven’t offset the $1.05 trillion deficit this fiscal year.

What happens next depends on Washington. Moody’s shifted its outlook to “stable,” suggesting no further cuts soon, but restoring AAA status would require serious reforms—either big spending cuts or revenue hikes, both politically toxic. Trump’s push for tax cuts could deepen the hole, especially if paired with his tariff plans, which Moody’s says may hurt long-term growth. Congress’s failure to pass the recent bill shows how tough consensus will be. For now, the US still borrows easily, but the downgrade signals a crack in its financial armor. If lawmakers don’t act, the cost of that crack could hit every American’s wallet.