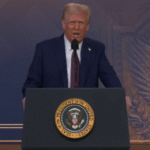

Washington, D.C. – President Donald Trump took aim at Walmart on Saturday, sharply criticizing the retail giant for announcing plans to raise prices due to his administration’s tariffs on imported goods. In a fiery post on Truth Social, Trump demanded that Walmart “eat the tariffs” and refrain from passing costs onto consumers, escalating tensions between the White House and the world’s largest retailer. The clash comes as Walmart, a bellwether of U.S. consumer health, warned that price increases on items like toys, electronics, and groceries could begin as early as late May, citing the high cost of tariffs despite recent reductions.

Walmart’s announcement followed a week of trade policy shifts. On Monday, the U.S. and China reached a 90-day truce, slashing tariffs on Chinese imports from 145% to 30%, while China reduced its levies on U.S. goods from 125% to 10%. Despite the de-escalation, Walmart executives said the remaining 30% duty on Chinese goods—along with a 10% baseline tariff on imports from other countries like Costa Rica, Peru, and Colombia—still pressures their thin retail margins. “We’re wired for everyday low prices, but the magnitude of these increases is more than any retailer can absorb,” Chief Financial Officer John David Rainey told CNBC on Thursday. CEO Doug McMillon echoed this, noting that tariffs on electronics, toys, bananas, and avocados were driving costs higher.

Trump’s response was swift and unyielding. “Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain,” he wrote. “Between Walmart and China they should, as is said, ‘EAT THE TARIFFS,’ and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!” The post, which gained traction on social media with users calling it a “bold ultimatum,” reflects Trump’s broader strategy of pressuring companies to shield consumers from tariff impacts. It also follows similar White House rebukes, including a call to Amazon founder Jeff Bezos last month after reports the company might highlight tariff costs on its platform, and a threat to impose a 100% tariff on Mattel’s toys after the toymaker flagged price hikes.

The retail industry is reeling from Trump’s trade war, which has disrupted supply chains and sparked fears of inflation. Walmart, which imports about 10% of its U.S. goods from China, has tried to mitigate costs by shifting some production to countries like India and urging suppliers to use materials like fiberglass instead of tariffed aluminum. Yet, McMillon acknowledged that items heavily reliant on Chinese manufacturing, like electronics and toys, remain vulnerable. Other retailers, including Target, Home Depot, and Lowe’s, are expected to address tariff impacts in upcoming earnings reports, while companies like Microsoft, Ford, and Mattel have already raised prices on consoles, cars, and toys. The Federal Reserve noted last week that tariffs have contributed to a 0.3% price increase this year.

Public reaction has been mixed. On social media, some users expressed frustration, with one writing, “Trump ran on lowering prices, then pushed tariffs that would empty your pockets,” while others praised his stance against corporate price hikes. Consumers are already feeling the pinch, with the University of Michigan reporting a 2.7% drop in consumer sentiment from April to May, partly due to tariff-related recession fears. Retail sales remained flat in April, as shoppers grew cautious, prioritizing spending on dining over goods. Walmart, however, reported a 4.5% rise in same-store sales and a 21% jump in U.S. e-commerce, signaling resilience among higher-income shoppers.

Economists warn the tariff burden will likely fall on consumers, not corporations or foreign governments, despite Trump’s insistence. “Businesses and the countries primarily eat the tariff,” Commerce Secretary Howard Lutnick claimed on CNN, a view dismissed as “ludicrous” by former Treasury Secretary Larry Summers. Walmart’s scale gives it more leverage than smaller retailers to negotiate with suppliers, but analysts say even they can’t fully absorb the costs. “There will likely be some demand destruction from tariffs, a complete wreck is unlikely,” said Brian Jacobsen of Annex Wealth Management.

Looking ahead, the 90-day trade truce adds uncertainty. Trump has warned that tariffs could rise again if negotiations with China falter, while talks with other nations continue. Walmart, which met—with Target and Home Depot—with Trump last month to warn of supply chain disruptions, has withheld second-quarter profit forecasts due to the “fluid operating environment.” As price hikes loom, the retail giant faces a delicate balance: maintaining its low-price reputation while navigating a trade war that shows no signs of cooling. For now, all eyes are on whether Walmart heeds Trump’s call—or passes the tariff costs to shoppers.