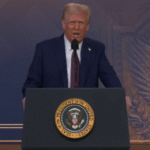

The U.S. Department of Education has announced the resumption of involuntary collection activities on defaulted federal student loans, effective Monday, May 5, 2025. This marks the end of a five-year pause on such collections, which was initially implemented in March 2020 during President Donald Trump’s first term as a response to the burgeoning COVID-19 pandemic.

The Department stated that the resumption of collections is intended to protect taxpayers and guide borrowers back into manageable repayment plans. This decision impacts millions of Americans who were in default on their federal student loans before or during the collection pause. Involuntary collection measures include wage garnishment and the offsetting of federal payments, such as tax refunds and Social Security benefits, to recover the outstanding debt.

According to an announcement from the Department of Education, this move follows the end of the broader pandemic-era student loan payment pause, which concluded in October 2023. While student loan repayments resumed for most borrowers at that time, the collection activities for those in default remained on hold until this recent announcement. The Department emphasized that this resumption is accompanied by a comprehensive communication and outreach campaign aimed at ensuring borrowers understand their options for returning to repayment or getting out of default.

Education Secretary [Replace with current Education Secretary’s name if found in search results, otherwise use title] stated that while borrowers have a primary responsibility to repay their loans, the Department is committed to providing resources and support to help them navigate the process. The Secretary also noted that colleges and universities have a role to play in reminding former students of their repayment obligations and guiding them to resources available on the StudentAid.gov website.

The resumption of involuntary collections has sparked varied reactions. Supporters of the move argue that it is a necessary step to restore fiscal responsibility and accountability for federal student loans, which are funded by taxpayer money. They contend that the extended pause cannot continue indefinitely and that those who willingly took out loans for their education have a legal and ethical obligation to repay them.

However, critics express concerns about the potential financial hardship this could impose on borrowers who may still be facing economic challenges. They argue that many individuals in default are likely to be those who are already struggling financially and that resuming aggressive collection tactics could further destabilize their lives. Concerns have also been raised about the adequacy of the support and outreach efforts to ensure that borrowers are aware of their options, such as income-driven repayment plans or loan rehabilitation programs, before involuntary actions are taken.

The Department of Education has indicated that it will be referring defaulted loans to the Treasury Department’s Treasury Offset Program. This program allows the government to collect delinquent debts by deducting funds from federal payments owed to the borrower. Following a 30-day warning notice, wage garnishments are also expected to commence.

For borrowers facing default, the consequences can be severe. Beyond wage garnishment and the withholding of federal benefits, default can lead to a significant drop in credit scores, making it difficult to obtain credit cards, auto loans, or mortgages in the future. It can also result in ineligibility for further federal student aid and the inability to purchase or sell assets.

The Department of Education urges borrowers in default to take immediate action to explore their options. They recommend contacting their loan servicer or visiting the StudentAid.gov website to learn about repayment plans, loan rehabilitation, and other resources available to help them resolve their default status and avoid involuntary collection measures. The Department has emphasized its commitment to working with borrowers to help them successfully navigate the return to repayment. The long-term economic impact of this policy shift on both borrowers and the broader economy remains to be seen.