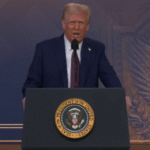

Washington is buzzing with a heated showdown over the state and local tax (SALT) deduction cap, and it’s got people on edge. Right now, the cap sits at $10,000, but a new push to raise it to $30,000 is stirring up a storm. President Donald Trump is trying to lock in the 2017 Tax Cuts and Jobs Act for good with what he calls his “one big, beautiful bill,” but this SALT debate might just throw a wrench in his plans. So, who’s coming out on top with this tax break, and why is raising the cap turning into such a messy fight?

Let’s break it down. The SALT deduction lets folks who itemize their federal taxes subtract some of their state and local taxes, like income or sales taxes, plus property taxes, from what they owe the federal government. Before the $10,000 cap kicked in back in 2017, it was a big help for people in high-tax states like California, New York, and New Jersey. Back then, two-thirds of the deduction’s benefits went to households making $200,000 or more, with the average deduction hitting $13,000—and even climbing past $30,000 in ritzy areas like Westchester County, New York. By 2020, only about 8.6% of federal tax returns claimed the deduction, but it was a lifeline for people in 13 high-tax states and Washington, D.C., where 10% to 20% of filers in places like Maryland and California leaned on it. These are usually upper-middle-class or wealthy homeowners who’ve been feeling the pinch ever since the cap came in.

Raising the cap to $30,000 would be a huge relief for these folks. Imagine a family in New Jersey shelling out $28,000 a year in property and income taxes—they’d be able to deduct the whole amount, saving them a nice chunk on their federal taxes. But here’s the rub: the benefits mostly go to the well-off. If the cap goes up, the top 20% of earners would see their tax cuts rise by about $2,500 on average, while the top 1%—those pulling in over $430,000—would see their savings jump from $40,100 to $71,000. Meanwhile, the bottom 80% of Americans, who mostly take the standard deduction ($15,000 for singles, $30,000 for couples in 2025), wouldn’t feel much difference at all. That’s why some are calling the SALT deduction a “handout for the rich,” saying it makes the tax system less fair by giving the biggest breaks to those who need them least.

This whole debate is splitting Republicans right down the middle. Lawmakers from high-tax states are fighting tooth and nail for their voters—think doctors, lawyers, and tech execs in places like Silicon Valley or Manhattan—who are getting hit hard by the $10,000 cap. In California, where even a modest house can come with a $12,000 property tax bill, the cap feels like a slap in the face. But their GOP colleagues from lower-tax states like Texas and Florida aren’t having it. Their constituents don’t pay as much in state and local taxes, so they rarely hit the cap and don’t see the point of the deduction. To them, raising it feels like a taxpayer-funded favor for wealthy blue-state folks. And with the Joint Committee on Taxation estimating a $915.6 billion cost over 10 years for a $30,000 cap, some Republicans are worried it’ll blow up the federal deficit at a time when money’s already tight.

The timing makes things even trickier. Trump’s got a lot on his plate—his tax plan includes pouring $175 billion into the Golden Dome missile defense system, and a new report just warned that melting ice sheets could displace 230 million people worldwide by the end of the century. Some lawmakers are asking: shouldn’t we be spending on things like seawalls or moving people out of flood zones instead of giving tax breaks to high earners? But those who want the cap raised say it’s about fairness. The SALT deduction has been around since 1913 to keep the federal government from double-dipping into state revenues—so why should people in high-tax states get the short end of the stick?

With the House set to vote as early as tomorrow, the SALT cap fight is hitting home for a lot of people. For well-off families in high-tax states, a higher cap could mean breathing a little easier. But for most Americans—and a nation facing big challenges like climate change and global tensions—it’s a tough pill to swallow. As the debate rages on, it’s clear this isn’t just about taxes—it’s about who we prioritize in a world that’s getting more complicated by the day.